TL:DR

Adaptation delivers outsized returns: For every $1 invested, businesses can expect $2–$43 in benefits, including avoided losses, operational efficiencies, and new revenue streams.

The opportunity is growing: The adaptation market could reach $9 trillion by 2050, creating significant upside for early movers.

A broader lens is essential: Real ROI comes from measuring and communicating both tangible and intangible benefits - well beyond the balance sheet.

As climate-related disasters grow in both frequency and severity, the business case for climate adaptation is shifting from peripheral concern to strategic imperative. Yet, many organisations still view adaptation through a narrow financial lens, focusing narrowly on upfront capital costs and immediate balance sheet impacts. This perspective risks overlooking the true, multifaceted return on investment (ROI) that climate resilience can yield; not only in avoided losses, but also in operational efficiency, competitive positioning, and long-term value creation.

The Expanding Business Case for Adaptation and Resilience

Historically, climate adaptation has been underfunded compared to mitigation, with governments shouldering most of the burden and private capital slow to follow. That’s now changing. According to a recent analysis by J.P. Morgan, every $1 invested in climate adaptation can yield between $2 and $43 in benefits. This broad range reflects the diversity of adaptation opportunities, from infrastructure hardening to supply chain fortification and digital weather intelligence.

A joint World Economic Forum and Boston Consulting Group report echoes this, with companies reporting a ROI of $2 to $19 per dollar invested. These figures are not just theoretical; they reflect real-world outcomes, such as avoided physical damage, reduced business interruptions, and enhanced stakeholder confidence.

Economic losses from extreme weather are rising in the U.S. and EU. As impacts of extreme weather grow, data now projects $1.2 trillion in annual losses for large corporations by the 2050s without adaptation. Simply put, maintaining the status quo destroys value.

Beyond Avoided Losses: The Triple Dividend of Adaptation

While the most immediate ROI from adaptation comes from avoided losses like damage from floods, wildfires, or heatwaves, this is only part of the story. Adaptation investments can also unlock what J.P. Morgan calls a “triple dividend”:

Operational Efficiency: Proactive resilience measures, such as water efficiency upgrades or heatwave contingency planning, often lead to lower operating costs and improved productivity.

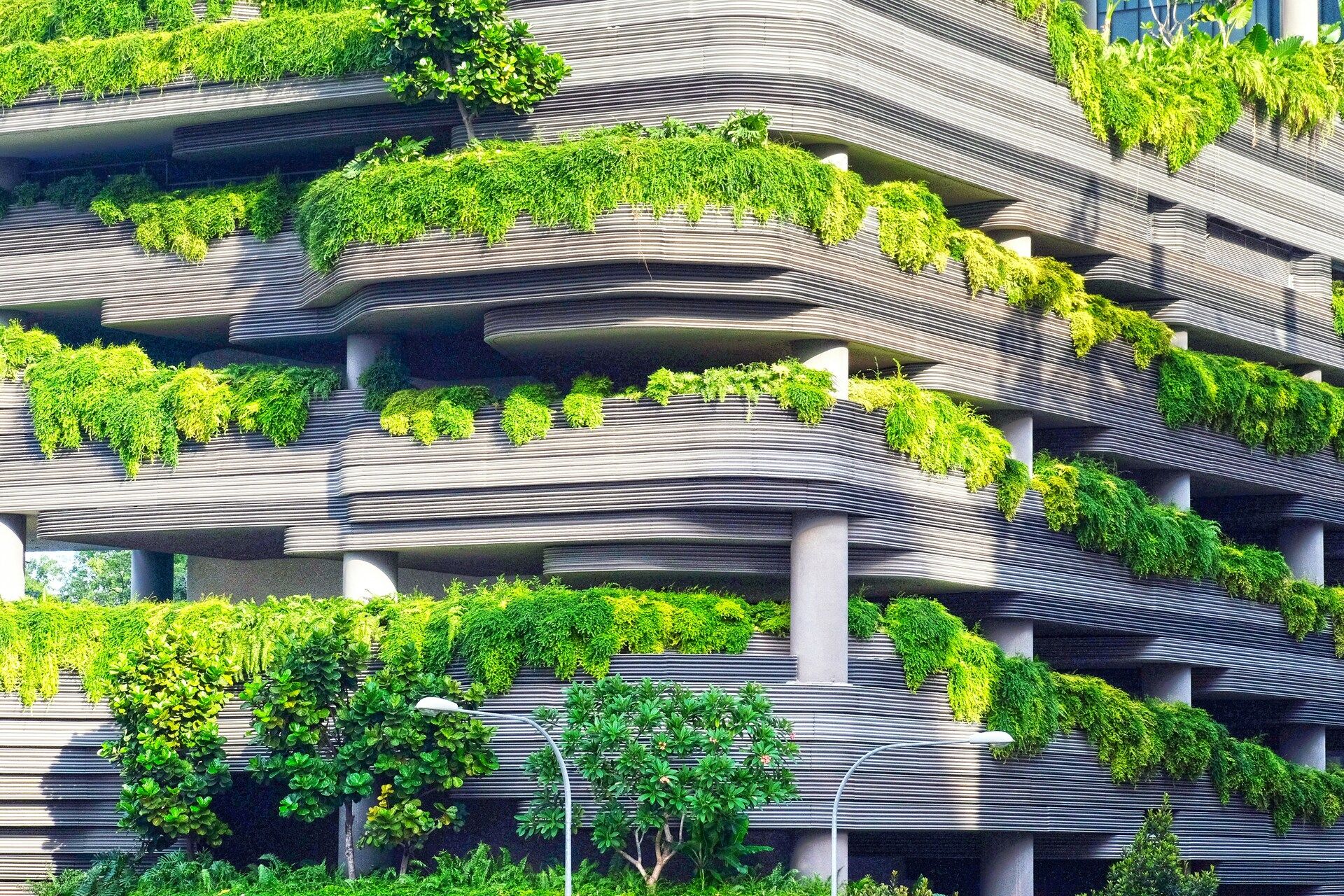

New Market Opportunities: As demand for adaptation solutions grow, businesses that innovate in areas such as resilient building materials, cooling technologies, or climate intelligence can access high-growth revenue streams.

Social and Environmental Co-Benefits: Adaptation projects frequently deliver broader societal gains, such as job creation, improved public health, and enhanced ecosystem services.

The WEF/BCG report highlights the “green advantage”: the ability for climate-resilient companies to attract top talent, boost brand equity, and drive top-line revenue growth from sustainable products and services. These tangible benefits are increasingly critical in markets where customers, investors, and regulators are demanding credible climate action.

The Investment Opportunity: Trillions at Stake

The market for climate adaptation solutions is poised for explosive growth. GIC and Temasek, two of Asia’s largest asset owners, estimate that the investable universe for adaptation could expand from $2 trillion today to $9 trillion by 2050. Analysts at Jeffries even suggest that adaptation investing strategies could outperform mitigation in the short term; with projected additional returns of 13.5% over one year and 21.1% over three years compared to investments in mitigation, based on a cross-sector analysis of 300 companies.

Importantly, the adaptation opportunity endures across climate scenarios. As GIC’s report highlights, “the adaptation investment opportunity remains significant regardless of the climate pathway that unfolds,” allowing investors and businesses to build resilience without needing to predict the precise course of climate change.

Measuring the Full Value: Beyond Traditional KPIs

To fully realise the ROI of adaptation, businesses must move beyond conventional KPI’s. Leading firms are incorporating metrics that better reflect the multidimensional value of resilience, such as:

Reduced downtime and supply chain disruptions

Increased employee retention and engagement

Market share growth in resilient or green products

Stakeholder trust and reputation indicators

Quantified social and environmental co-benefits

By embedding these metrics into strategic planning and reporting, companies can more effectively articulate the business case for adaptation-both internally and to investors.

Are Businesses Underestimating Their Vulnerability?

Despite mounting evidence, many businesses continue to underestimate their vulnerability to climate risks. Cognitive biases, short-termism, and a lack of robust data lead to a passive “wait-and-see” approach. But as recent catastrophic climate events and future projections make clear, inaction is itself a costly gamble. The true ROI of adaptation is not just about safeguarding assets, it’s about positioning for growth, innovation, and leadership in a rapidly changing world.

In the era of climate volatility, resilience is more than risk management. It’s a forward-looking investment in durability, competitiveness, and long-term value. The time to invest is now.

Know someone interested in adapting to a warmer world? Share Liveable with someone who should be in the know.

Or copy and paste this link to share with others: https://research.liveable.world/subscribe