The State of Adaptation Finance Flows into Innovation

As catastrophic weather events reshape our world, the harsh reality of our changing climate demands a fundamental shift towards technologies that help us adapt to an environment with more extreme extreme’s. The numbers speak for themselves: global spending on climate adaptation could reach $1.3 trillion annually by 2030, with global annual revenue from climate adaptation solutions growing from $1 trillion today to $4 trillion by 2050. Yet, the latest reporting shows adaptation finance reached only $76 billion in 2022 - less than 5% of total climate finance flows. This represents not just a funding gap, but the investment opportunity of a generation.

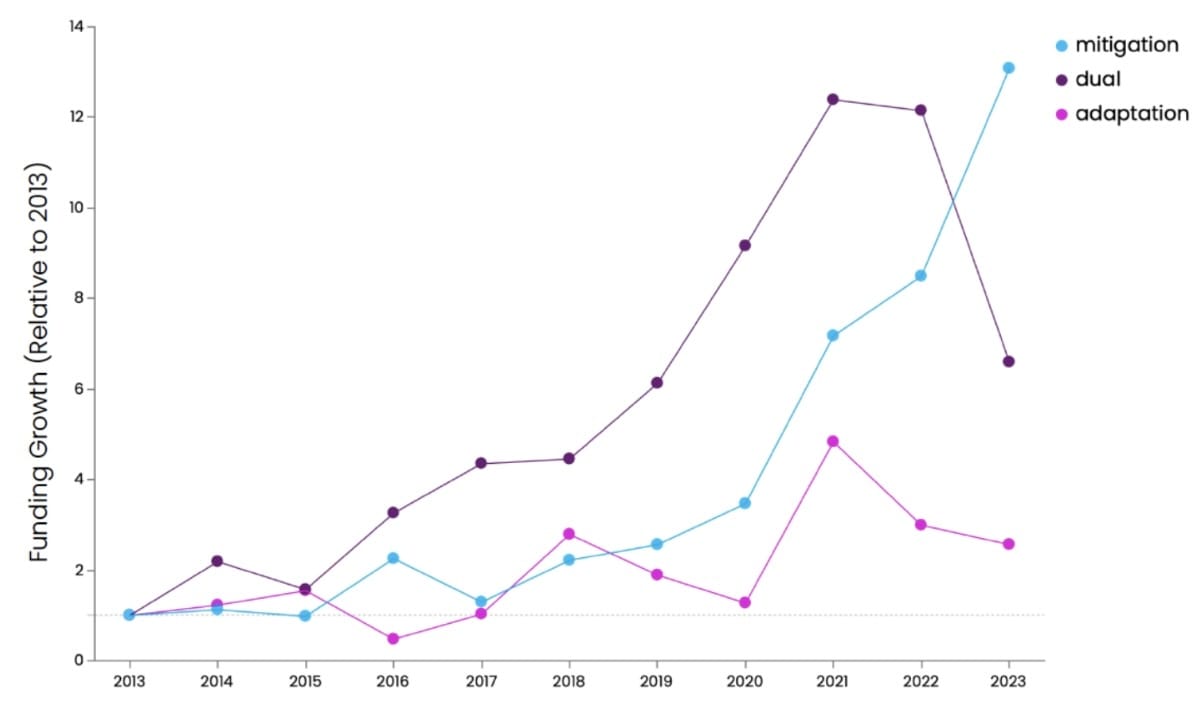

Despite future forecasts of significant climate adaptation and resilience market growth, adaptation technologies remain critically underfunded, receiving only 1.6% of all private investment in climate. As extreme weather events become more frequent and severe, the question is no longer whether we need climate adaptation technologies, but which innovations can scale fast enough to meet the mounting challenge.

Source: Data from Crunchbase; Chart by Tailwind and Vibrant Data Labs

Building Fortress Infrastructure: The Foundation of Climate Resilience

Infrastructure represents the backbone of climate adaptation. With an annual investment of $6.9 trillion in infrastructure necessary by 2030 to ensure global infrastructure is compatible with a 1.5°C warming pathway, mature technologies ready for deployment today, alongside emerging innovations, are critical for transforming how we build a more liveable future.

While physical infrastructure like sea walls typically comes to mind when considering resilience infrastructure for a warming world, digital infrastructure plays as critical a role, particularly in the AI era. Technologies for advanced weather prediction, flood forecasting and wildfire detection are becoming extraordinarily advanced, underscored by the release of AlphaEarth Foundations by Google last week, providing a next-generation capability for Earth observation.

The infrastructure sector's true innovation frontier lies in technologies still requiring patient capital. Climate-resilient transportation infrastructure could revolutionise how we move people and goods in an era of extreme weather. These technologies demand substantial capital commitments, but offer the prospect of stable, long-term returns through infrastructure funds backed by government policy support.

“Some impact investing funds are now looking at the damage from cyclones, increased wildfires, flooding, and seeing that they can have real impact by investing in adaptation. Think of this as part of the business strategy in terms of resilience of future cashflow, but also maximising the returns.”

The infrastructure investment landscape reveals both challenges and opportunities. While mature technologies can attract traditional project finance, breakthrough innovations like next-generation seawater desalination solutions and ultra-energy-efficient, alternative refrigerant air conditioning systems require alternative sources of capital. Investors must balance the sector's inherent capital intensity against the potential for transformative returns in a market where climate resilience becomes increasingly valuable.

Feeding the Future: The Frontline Fields of Adaptation Innovation

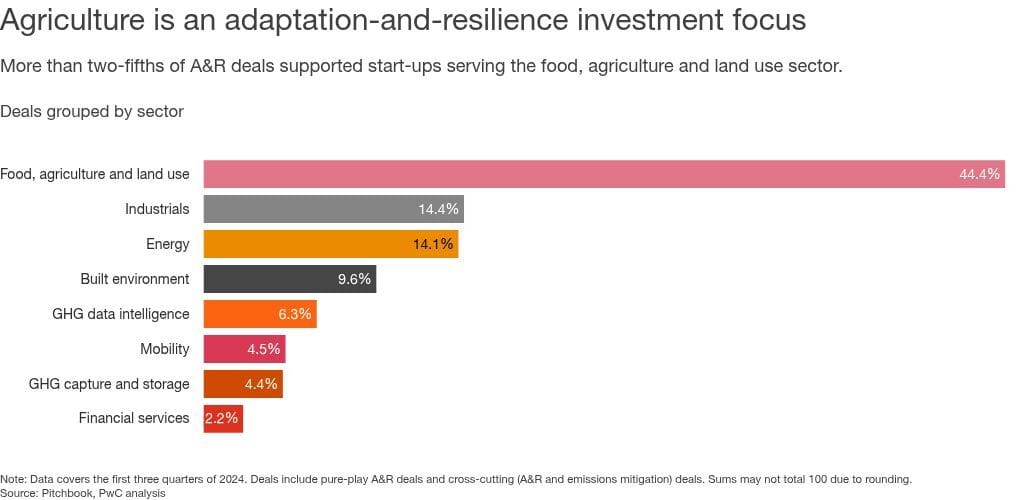

If infrastructure provides the foundation for resilience, agriculture represents its most immediate application. The sector has already demonstrated openness to innovation, attracting $5.7 billion in funding since 2012 for adaptation technologies targeting smallholder farmers in emerging markets alone, predominantly from venture capital, private equity and impact funds. This investment has yielded tangible results: precision agriculture solutions like CropX have achieved 30% savings in input costs, 10% improvements in yield, and water savings of 30%.

The agricultural adaptation technology landscape contains a diversity of commercially ready solutions and emerging innovations. Precision agriculture and IoT applications - soil monitoring systems, satellite-based crop monitoring, and AI-powered pest detection, have moved beyond pilot projects into widespread commercial deployment. These technologies demonstrate clear return on investment and established market demand, making them attractive to growth capital investors seeking proven business models.

Agriculture's adaptation challenge extends far beyond efficiency gains. Heat and drough resistent crop varieties, post-harvest loss reduction technologies, and climate-resilient livestock management systems represent the sector's next innovation wave. These technologies require additional development funding but promise to address fundamental challenges: how to maintain food security as weather become increasingly extreme and unpredictable.

Agricultural adaptation technologies also benefit from clear stakeholder alignment. Farmers have immediate economic incentives to adopt technologies that reduce input costs and increase yields, while consumers and governments have longer-term interests in food security. This alignment creates multiple funding pathways, from venture capital for technology development to development finance for smallholder farmer access.

Source: State of Climate Tech 2024, PwC

Health’s Climate Adaptation Technology Challenge

Health resilience presents climate adaptation's most undeveloped innovation landscape. The sector also accounts for 4.5% of global greenhouse gas emissions, creating both requirements for adaptation and mitigation. Unlike infrastructure or agriculture, where climate impacts are primarily economic, health confronts an additional challenge with direct threats to human life and wellbeing.

Digital health solutions for climate adaptation remain largely in the development stage, representing a significant opportunity for capital allocators. Heat stress management systems, vector-borne disease surveillance platforms, and AI-powered climate health risk prediction tools are transitioning from R&D into pilot projects. Predictive modelling for disease outbreak prevention and climate disaster resilient health infrastructure represent the sector's innovation frontier. These technologies require interdisciplinary collaboration and long development timelines, but will transform how healthcare systems respond to extreme health challenges resulting from climate change.

The healthcare sector's investment profile differs markedly from infrastructure or agriculture. Returns may be longer-term and less predictable, while the societal impact potential is significant. Liveability technologies in health benefit from multiple funding sources, including government health agencies, philanthropic organisations, and impact investors seeking measurable social outcomes.

The Innovation Investment Imperative for Liveability Solutions

The climate adaptation technology landscape presents a complex but compelling investment opportunity. The market's significant potential for societal and economic returns represents one of the largest transitions in human history, yet current funding levels fall dramatically short of what’s needed. This gap creates vast opportunities for investors willing to support technologies across the innovation spectrum, from breakthrough research to scaling solutions.

The sector's investment requirements vary dramatically by application area. Physical infrastructure demands large capital commitments but offers stable, predictable returns and policy support. Agriculture presents proven business models and clear stakeholder incentives. Health requires patient capital for longer development cycles but promises to deliver a transformative societal impact.

The urgency of climate adaptation creates both opportunities and risks for technology investors. Early movers can capture significant market share in rapidly emerging sectors like parametric insurance, but technology risk remains for novel innovations. As extreme weather becomes the new normal, liveability innovations will transition from an insurance policy to essential infrastructure. Investors who recognise this transition early will be best positioned to capture value in what may prove to be the defining investment theme of the coming decade.

The Bright Spark

The upcoming COP30 will place an increasing focus on climate adaptation. The COP30 President has stated that “adaptation is no longer an option”, and ambitions for adaptation funding to form a major pillar of the much contested mobilisation of climate finance, with $1.3 trillion per year for climate action sought by developing countries by 2035.

The Tipping Point

While starting from a low base, capital flows into adaptation more than doubled from $35 billion to $76 billion from 2018-2022, representing an annual growth rate of 21%.

To Truth, Justice and a Better Tomorrow.

Know someone interested in adapting to a warmer world? Share Liveable with someone who should be in the know.

Or copy and paste this link to share with others: https://research.liveable.world/subscribe