The Essentials:

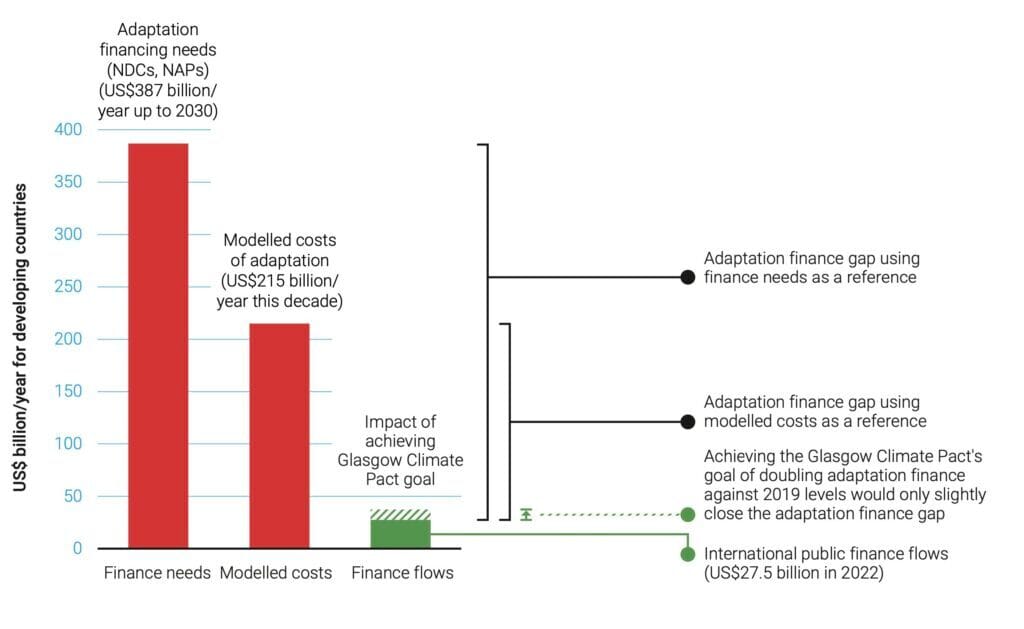

The adaptation finance gap is significant: $215–387 billion/year is needed vs. only $28 billion delivered in 2022; even doubling by 2025 barely makes a dent.

The gap is structural: high‑impact projects generate public benefits but few cash flows, deterring private capital and biasing toward small, “no‑regret” investments.

New tools exist but are early: debt‑for‑adaptation swaps, disaster‑risk instruments, and blended or performance‑based finance work in pilots, but are yet to scale.

What would unlock scale: standardised contracts, dedicated project origination facilities, and rigorous, quantified metrics embedded in adaptation instruments.

The Unbridgeable Structural Gap, for Now

Adaptation finance remains the poor cousin of climate spending. The Adaptation Gap Report 2024 estimates that developing countries require $215–387 billion annually to weather rising physical risks. Actual international public flows reached $28 billion in 2022, up from $22 billion a year earlier - the largest single-year increase since the Paris Agreement in 2015. Even if developed countries meet the Glasgow Climate Pact’s goal of doubling adaptation finance by 2025, the gap would shrink by a mere 5%.

The problem is structural. Adaptation projects often deliver diffuse public-good benefits, with few monetisable cash flows. That makes them unappealing to private capital, which today provides barely 1.6% of tracked adaptation finance. Closing the gap will require financial innovation on a scale climate policy has yet to muster.

The Old Toolkit Just Won’t Do

Traditional financing mechanisms: grants, concessional loans, and standard project finance, are ill-matched to adaptation’s economics. Resilience investments, for example mangrove buffers or upgraded urban drainage systems, generate immense avoided-loss value but no obvious revenue stream. Private investors see uncertain returns, high political risk, and thin liquidity in secondary markets.

The Adaptation Gap Report underscores this. The easiest money flows into “no-regret” incremental projects in marketable sectors like resilient commercial farms and water-saving manufacturing, while high-value, transformational projects in non-market sectors languish. The latter is precisely where vulnerability is greatest.

An Emerging Financial Architecture for Adaptation

Debt-for-Adaptation Swaps

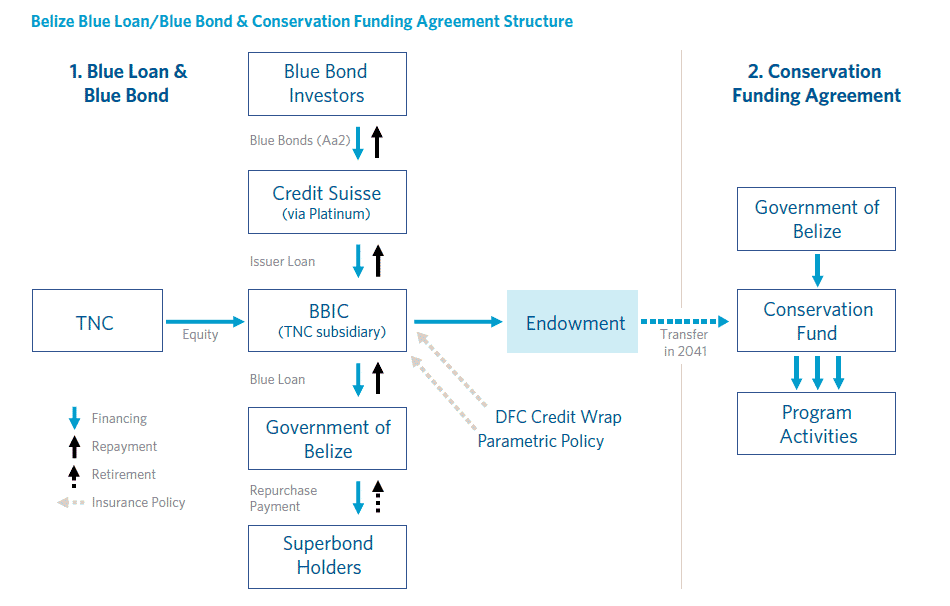

Pioneered in conservation finance, these instruments restructure sovereign debt in exchange for commitments to invest locally in resilience. Barbados’ 2024 ‘debt-for-adaptation’ swap, backed by the Inter-American Development Bank and the European Investment Bank, generated $125 million in fiscal savings which will be used to enhance water resource management and increase water and food security. Belize’s 2021 ‘debt-for-conservation’ swap directed $180 million into marine protection. Such deals create fiscal space without adding debt, but require complex negotiations, structuring and trusted intermediaries.

Disaster-Risk Instruments

Parametric insurance, catastrophe bonds, and climate-resilient debt clauses are gaining traction. The latter, now embedded in some World Bank and bilateral loans, allow repayment suspension after declared climate disasters, freeing budget for recovery. The Caribbean Catastrophe Risk Insurance Facility has disbursed more than $250 million since its creation, demonstrating how parametric thresholds enable rapid liquidity for disaster‑affected economies.

Adaptation-Focused Investment Funds

Private investment managers are tentatively entering the space. Invesco’s Climate Adaptation Action Fund targets $500 million for public and private placement bonds supporting adaptation initiatives. Mazarine Climate and Convective Capital are carving niches in water and wildfire risk management, respectively; sectors alongside the likes of weather intelligence and drought-resistant crops, which are estimated by Bain & Company and GIC to see revenues rise from $1 trillion today to $4 trillion by 2050, with half the growth directly driven by climate change.

Performance-Based Instruments

Drawing on social-impact bonds, adaptation-linked payment contracts release funds only if resilience targets, such as reduced flood-damage incidence, are met. The Global Environment Facility has piloted performance-based climate-resilience grants, while innovators are exploring ‘resilience credits’ akin to carbon offsets, tradable on voluntary markets.

Integrated Market Mechanisms

Frontier proposals link adaptation finance to carbon markets or GDP-indexed bonds. “Climate-contingent” sovereign debt, with adjusted repayments following disaster events, could reduce fiscal stress and stabilise state credit profiles. Such structures remain largely theoretical, but are increasingly drawing interest at climate finance forums.

Catalytic and Blended Finance

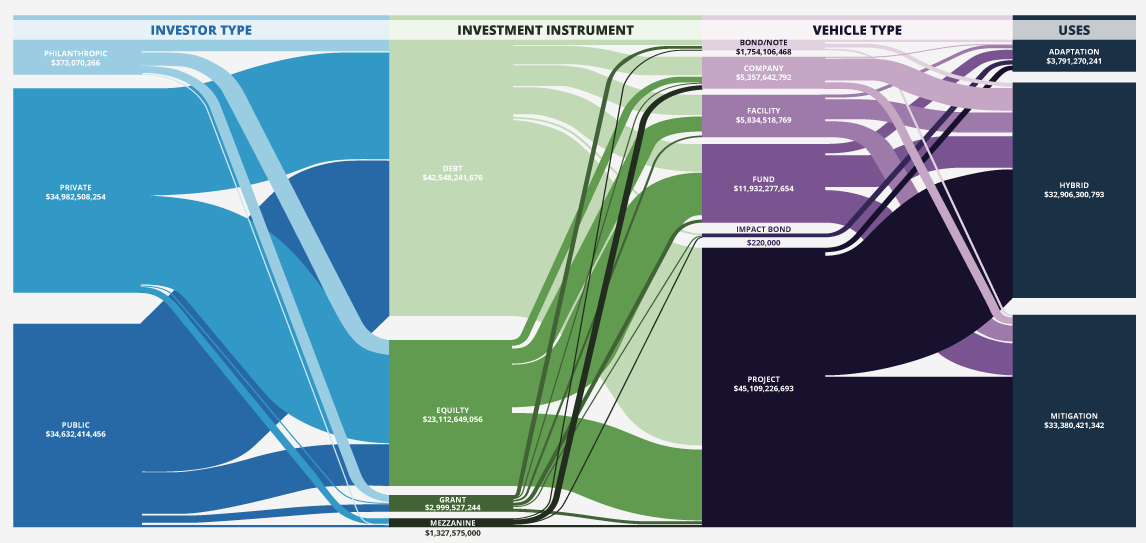

Blended structures combine concessional public or philanthropic capital with private investment, absorbing first-loss risk to attract commercial lenders. Instruments such as subordinated debt tranches, guarantees, and currency-risk hedges are being deployed by the Green Climate Fund and multilateral banks to de-risk agritech, resilient housing, and urban cooling projects.

Promise vs. Peril: Trade-Offs in Novel Adaptation Finance Models

Strengths

Additionality: Innovative instruments mobilise new flows rather than divert existing aid budgets.

Leverage: Blended finance can crowd in multiples of private capital per public dollar.

Incentive Alignment: Performance-based models reward measurable resilience gains.

Fiscal Relief: Swaps and clauses create fiscal headroom when disasters strike.

Weaknesses

Complexity & Cost: Debt-swap transactions can take years and millions in advisory fees to structure and negotiate.

Capacity Constraints: Low-income countries may lack the institutional machinery to originate and monitor such deals.

Risk of Greenwashing: Without rigorous metrics, funds could back projects with tenuous adaptation benefits.

Scalability Limits: Without a wholesale reform of development finance, niche instruments may never reach the trillions needed.

From One-Offs to the Operating Model

Three imperatives emerge from early experience:

Standardisation: Streamlined legal templates for swaps, resilience bonds, and performance contracts to cut transaction costs and timelines.

Institutionalisation: Dedicated adaptation investment facilities - national or regional - to prepare, bundle, and market bankable projects.

Mainstream Metrics: Agreed global frameworks for defining and verifying adaptation outcomes are essential to unlock private participation and avoid perverse incentives.

COP29’s negotiations on the New Collective Quantified Goal for climate finance are a window to embed these innovations in mainstream development finance. Multilateral development banks and large institutional investors should be incentivised to integrate adaptation into core portfolios, not just as an add-on.

Make-or-Break: Turning Pilots into Portfolios

Adaptation finance is entering a make-or-break period. Physical risks are accelerating faster than governance or capital markets can adapt. Fortunately, innovation is no longer hypothetical: from Bridgetown to Belmopan, from catastrophe-linked bonds to resilience-linked investment funds, a new architecture is taking shape.

But these models will matter only if they graduate from pilot to portfolio scale. The alternative is to keep throwing sandbags - literally and figuratively - against a rising tide, with each year’s costs and casualties higher than the last. In a hotter world, adaptation finance is not charity, but self-interest dressed in fiscal prudence.

The Bright Spark

New adaptation finance models are gaining traction. Blended finance is mobilising higher levels of capital from the private sector when compared to the broader climate adaptation market, with 33% of blended adaptation financing coming from private sources of capital.

The Tipping Point

Albeit from a low base, total climate adaptation finance more than doubled from $35 billion in 2018 to $76 billion in 2022.

To Truth, Justice and a Better Tomorrow.

Know someone interested in adapting to a warmer world? Share Liveable with someone who should be in the know.

Or copy and paste this link to share with others: https://research.liveable.world/subscribe