The Essentials:

Unlike carbon credits’ universal metric (tCO₂e), adaptation lacks a standardised measure; resilience benefits are local, multidimensional, and difficult to compare.

New financial architectures are emerging: Duke University’s Resilience Monetisation and Credits Initiative and the Climate Bonds Initiative’s Resilience Taxonomy are laying the groundwork for tradeable resilience instruments.

Early pilots show impact: FM Global has deployed over $1 billion in resilience credits since 2022, helping clients cut potential economic losses by $30 billion.

The business case is strong: every $1 invested in adaptation yields over $10 in benefits, with average returns of 27% - rising to 78% in the health sector.

The Quantification Problem

The dearth of finance in adaptation is perilous, with the lack of tools to quantify investment performance being a consequential factor. While carbon markets benefit from a simple universal metric - the tonne of CO₂ equivalent, resilience stubbornly resists such elegant quantification. A mangrove restoration project in Bangladesh, flood barriers in Miami, and drought-resistant crops in Kenya all build resilience, but comparing their value propositions is like comparing apples to seawalls.

This ‘carbon envy’ is a key element explaining why private capital provides less than 2% of tracked adaptation finance. Institutional investors crave fungible, tradeable instruments that allow portfolio-level risk management and performance benchmarking. Without standardised metrics, adaptation investments remain bespoke, illiquid, and difficult to scale.

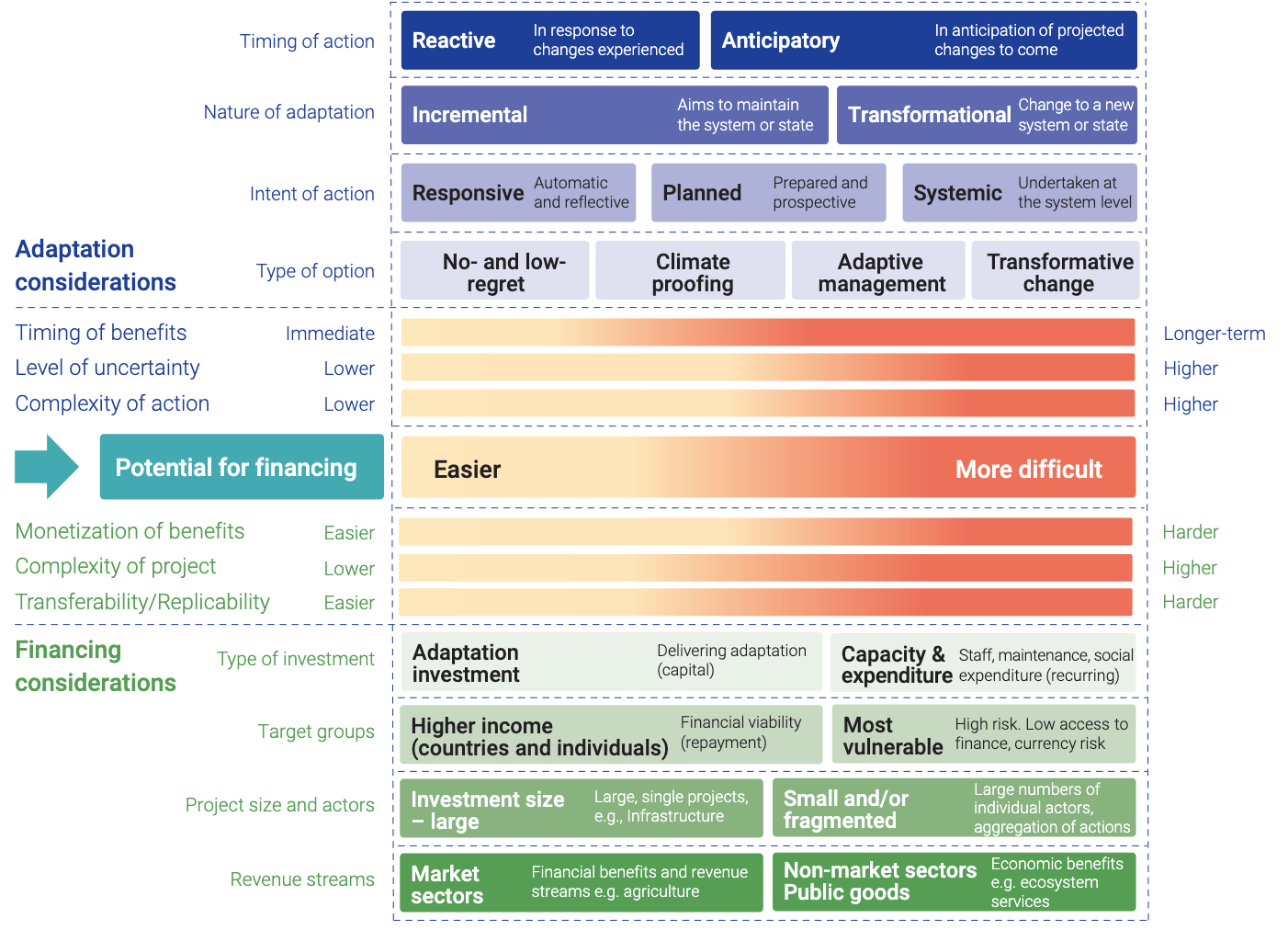

The result is a structural bias toward what adaptation specialists call “no-regret, reactive and incremental” projects in market sectors (gene-edited crops, parametric insurance), while transformational adaptation in non-market sectors (flood defences, ecosystem restoration) - precisely where vulnerability is greatest - languishes for want of capital.

Credit Where Credit is Due: The Resilience Architecture

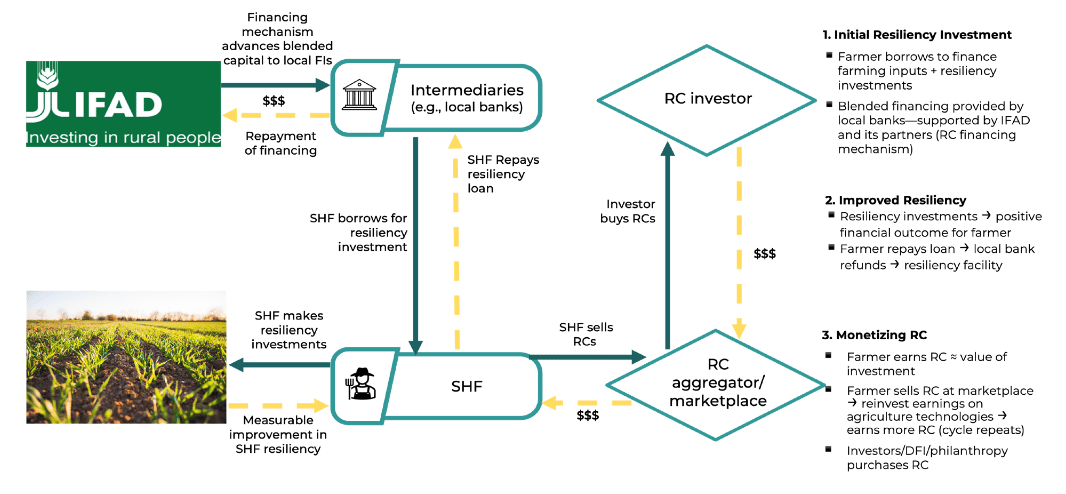

A financial architecture for ‘resilience credits’ is taking shape. Duke University’s “Resilience Monetization and Credits Initiative” (RMCI), developed with the International Fund for Agricultural Development and Egypt's Ministry of International Cooperation, represents the most advanced effort to operationalise tradeable resilience instruments. The initiative aims to establish "a new asset class that aligns public and private capital to deliver investment into projects and businesses that are addressing social, economic and environmental drivers of vulnerability."

The concept is gaining institutional traction. The Climate Bonds Initiative has developed a Resilience Taxonomy integrated into its certification standard, while multilateral development banks have established a joint methodology for tracking adaptation finance that requires demonstrating climate vulnerability context, explicit adaptation intent, and clear links between activities and risk reduction.

Real Money, Real Impact

The business case is compelling. FM Global, a commercial property insurer, has pioneered practical resilience credits, allocating over $1 billion since 2022 to help clients invest in climate resilience measures. The programme provides 5% premium offsets for eligible policies, creating direct financial incentives for risk reduction.

The results are striking: FM clients have increased implementation of risk mitigation strategies, driving a potential reduction in economic impact of more than $30 billion. This mutual insurance model demonstrates how resilience credits can align insurer and policyholder interests around prevention rather than claim payouts.

Recent research provides compelling evidence for resilience investment returns. A World Resources Institute study of 320 adaptation projects across 12 countries found that every $1 invested generates over $10 in benefits over ten years, with average returns of 27%. Health sector investments showed even higher returns of 78%.

The Measurement Maze

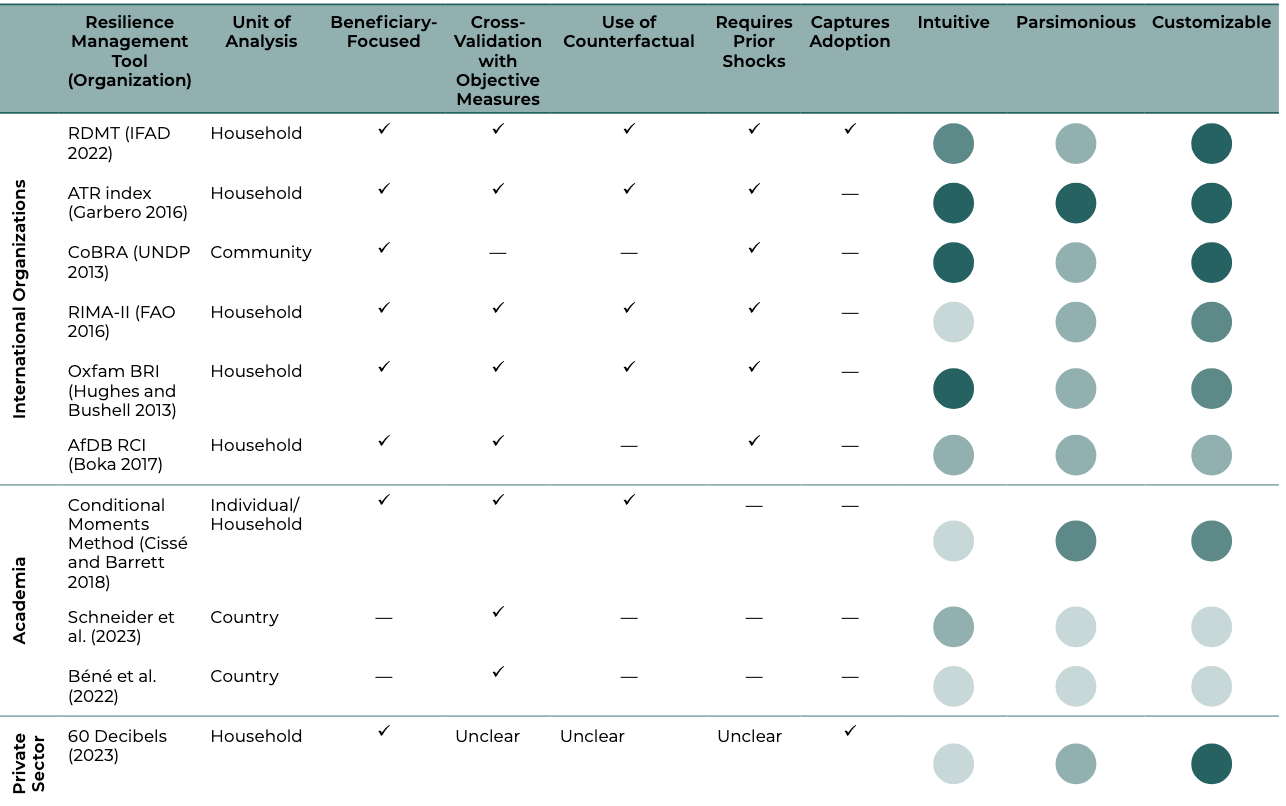

The central challenge remains quantification. Unlike carbon's straightforward accounting, resilience measurement faces fundamental complexities around context-specificity, multidimensional benefits, and attribution. Research identifies over 300 different adaptation and resilience metrics across 30+ institutional frameworks, highlighting both the richness of measurement approaches and the challenge of standardisation.

The RMCI proposes to address this through a pragmatic approach: "supporting a validation and replication agenda that takes a systematic meta-analytic approach to understanding the factors influencing the value of resilience interventions." Rather than pursuing perfect fungibility, the initiative suggests using scenario modelling with different levels of resilience to provide insights into the average value of specific investments and their varying outcomes.

This approach acknowledges a fundamental tension. Adaptation benefits are inherently local - a seawall in Miami delivers different value than drought-resistant agriculture in Kenya. Yet financial markets crave standardisation and comparability. The solution may lie in embracing context-specificity rather than fighting it, creating location- and risk-specific credits that maintain transparency while allowing targeted investment.

The Private Sector Pivot

Despite promising developments, significant obstacles remain. The UK Climate Financial Risk Forum identifies concerns about data quality and relevance, lack of clarity on climate scenarios, insufficient guidance on integrating scenario analysis into investment decisions, and absence of consensus on standards for adapted assets.

That said, corporate buyers are beginning to emerge. Companies face mounting pressure from new climate disclosure requirements that will replace TCFD standards with more demanding ISSB frameworks. The UK Financial Conduct Authority analysis identifies "lack of consensus on standards and definitions for adapted assets" as a primary barrier to scaling adaptation finance.

Parametric insurance is emerging as a critical bridging mechanism, with insurance and reinsurance companies presenting particularly compelling buyers. Swiss Re, Munich Re, and their peers have natural hedging incentives to purchase resilience credits that reduce their portfolio risk exposure. A corporate buyer in a flood-prone region could purchase location-specific flood resilience credits, creating direct portfolio protection while supporting local adaptation.

Parametric insurance is a financial instrument that provides rapid payouts based on pre-defined triggers e.g. rainfall of <150mm over a 3-month period, rather than traditional damage assessments, offering the transparency and standardisation that resilience credit markets will require.

Scale or Fail

Three imperatives emerge for resilience credits to achieve scale. First, standardisation efforts must balance global consistency with local relevance. Rather than forcing universal fungibility, resilience credits may succeed by creating transparent, verifiable standards for different risk types and geographies.

Second, the financial industry requires dedicated infrastructure for origination, verification, and trading. The Climate Finance Lab's analysis emphasises building adequate project pipelines with optimal cash flows, strategic structuring around risk and return, and simplified structures to reduce perceived structural risks.

Third, blended finance mechanisms must de-risk private investment while maintaining additionality. Government guarantees, first-loss provisions, and technical assistance facilities can address the market failures that constrain private adaptation finance without crowding out public investment in non-market goods.

The Make-or-Break Moment

As physical climate risks mount and adaptation needs grow, the development of effective resilience credits may prove not just financially attractive but essential for global climate resilience. The concept benefits from timing - growing regulatory pressure, demonstrated investment returns, and emerging institutional frameworks converge around urgent adaptation needs.

Success will require acknowledging that resilience credits may never achieve carbon's elegant simplicity. Instead, their value may lie in creating verifiable, location-specific risk reduction instruments that enable targeted investment while maintaining transparency through digital verification systems. MSCI analysis using AI identified over 800 publicly listed companies (11% of global listings) contributing to climate adaptation and resilience, suggesting substantial market potential.

The stakes could not be higher. COP29’s agreement to mobilise $1.3 trillion annually by 2035 for climate action in developing countries creates both opportunity and urgency. With adaptation needs in developing countries standing at around $300 billion per year, resilience credits could play a crucial role in mobilising the required private capital.

In a warming world, the question is not whether to develop resilience credits, but whether their financial architecture can match the complexity of climate adaptation while maintaining the simplicity needed for institutional scale. The early evidence suggests the challenge is formidable but not insurmountable, and the alternative of inadequate adaptation finance is far worse.

The Bright Spark

The Caribbean Catastrophe Risk Insurance Facility has disbursed over $250 million since its creation, demonstrating how parametric thresholds enable rapid liquidity for disaster-affected economies.

The Tipping Point

Resilience retrofit bonds are forecast to grow from $7.8 billion in 2024 to $22.1 billion by 2033, expanding at a compound annual growth rate of 12.4%.

To Truth, Justice and a Better Tomorrow.

Know someone interested in adapting to a warmer world? Share Liveable with someone who should be in the know.

Or copy and paste this link to share with others: https://research.liveable.world/subscribe