Investment

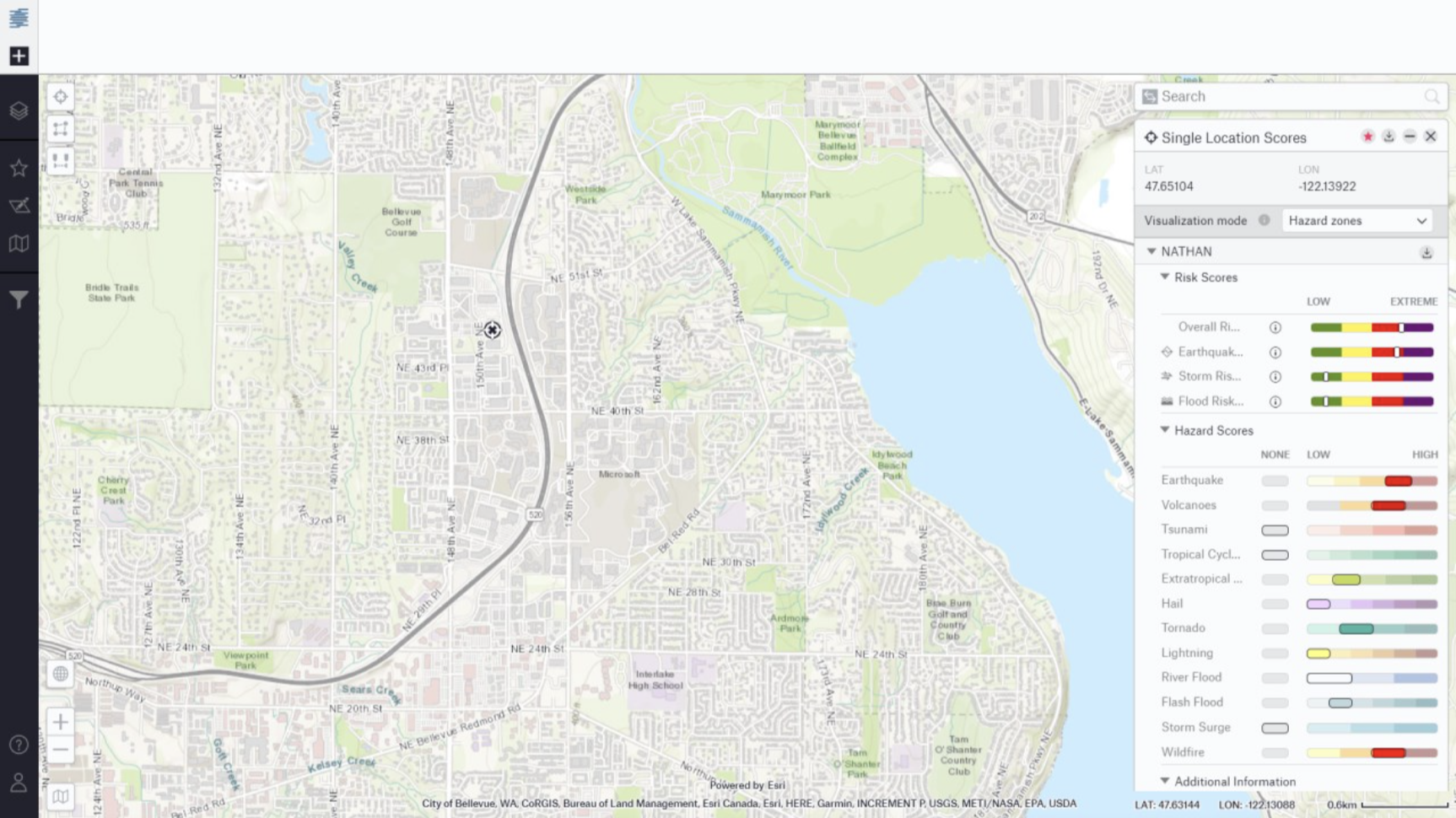

Issue 17: From Underwriters to Adaptation Architects: What Role Should Insurers Play in Advising on Climate Adaptation?

Tracking the insurance industry's transformation from risk carriers to adaptation architects. As climate losses render traditional models obsolete, insurers are selling data-driven resilience services—but does this pivot create a dangerous conflict when those who assess the risk also profit from the solution?

Analysis

+3

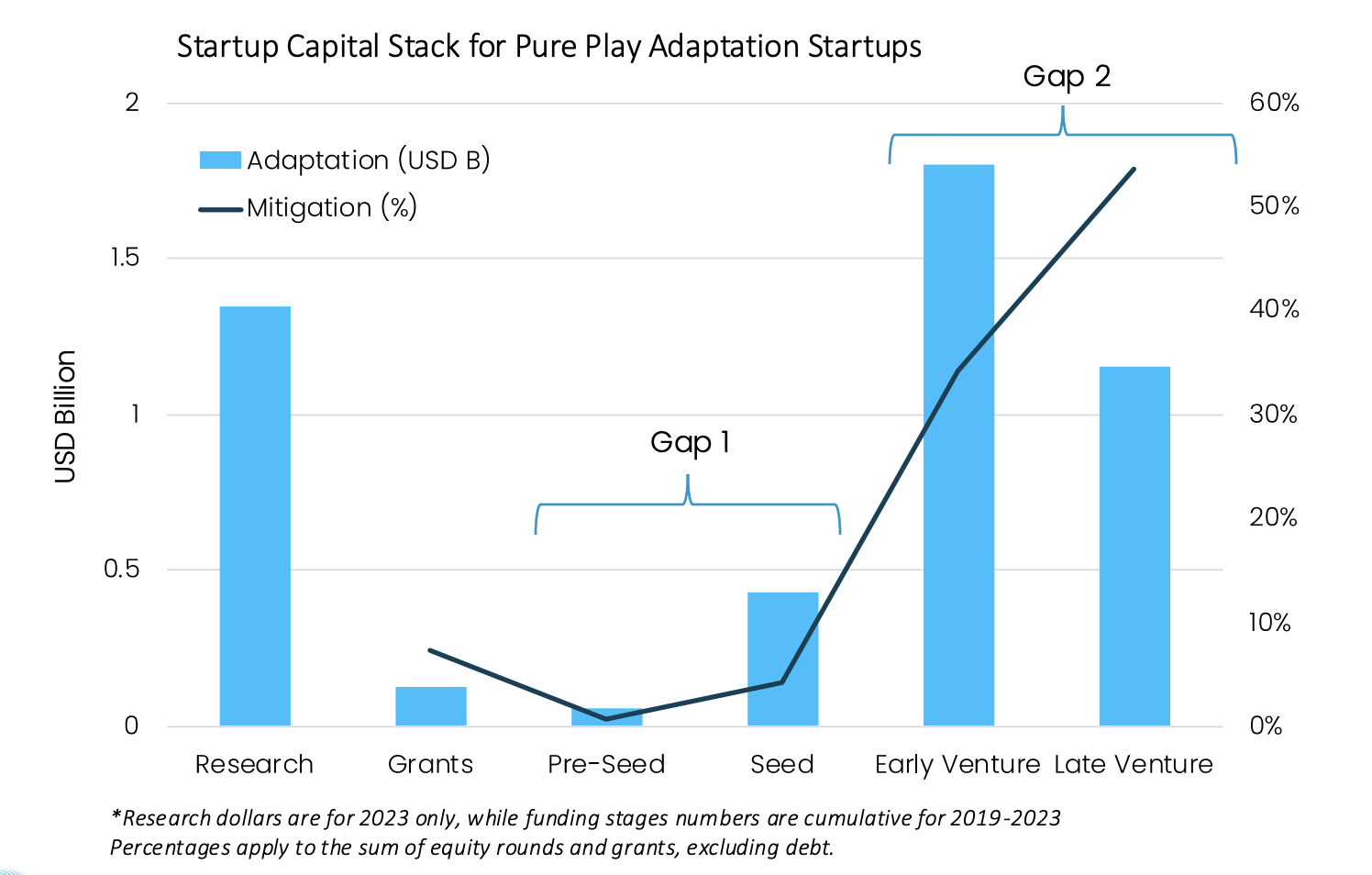

Issue 11: Building Resilience or Building Debt? A Review of the State of the Climate Adaptation Capital Stack

Taking a critical look at the adaptation capital stack - the financial market infrastructure meant to deliver more than $200 billion annually for climate resilience. Despite sophisticated instruments and institutional mobilisation, fundamental design flaws keep adaptation finance trapped at a fraction of what's needed.

Analysis

+3

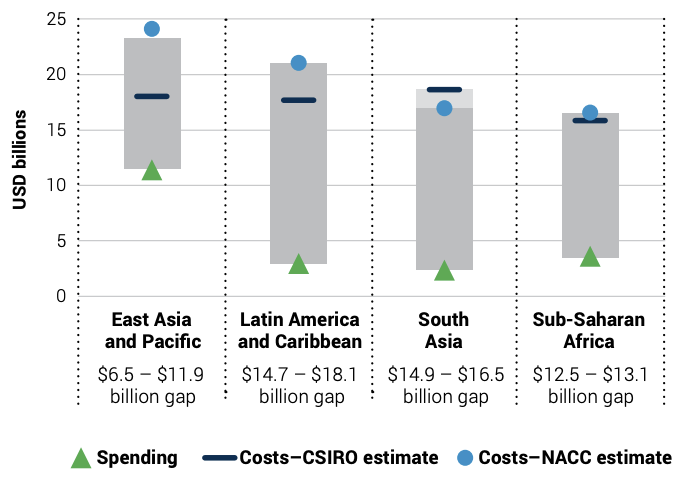

Issue 8: Beyond the Billions - Where is Adaptation Finance Actually Going? (and is it working)

Exploring whether adaptation finance is doing its job. The cash has doubled, but the cracks are widening - suggesting the resilience business is still more aspiration than achievement.

Analysis

+3

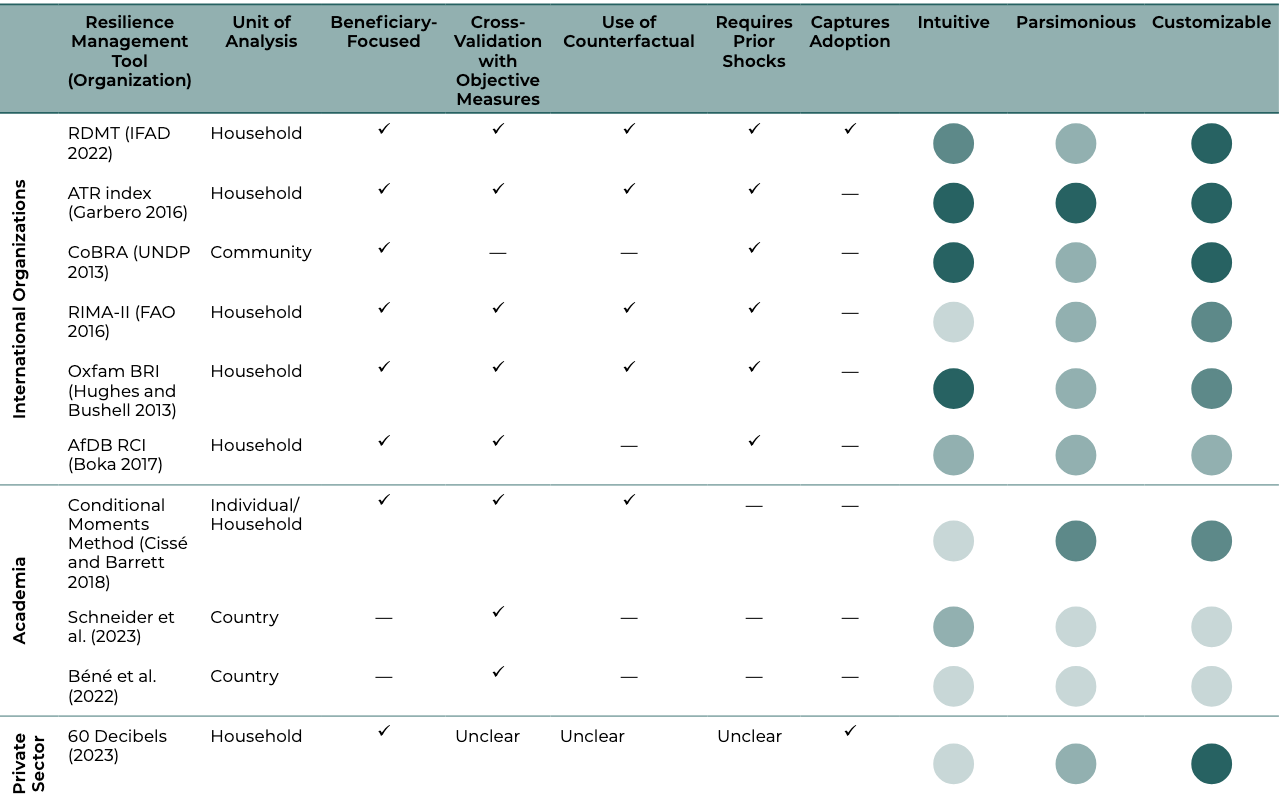

Issue 6: Monetising Resilience - Building the Financial Architecture for Resilience Credits

Exploring the rise of ‘resilience credits’ as an opportunity for private sector adaptation finance. With private capital sticking to the sidelines and measurement challenges unresolved, early pilots and new financial architectures are beginning to show how adaptation could finally scale.

Analysis

+3

Issue 4: Innovation in Adaptation Finance - What New Models Are Emerging?

The novel models aiming to bridge the mammoth climate adaptation financing gap, with blended finance demonstrating a crowding in effect, and adaptation finance on a growth trajectory.

Analysis

+3